- July 12, 2023

- Insurance

In the exciting world of real estate, there are many key players involved in ensuring a successful transaction. While real estate agents, lenders, and attorneys often take the spotlight, there’s an unsung hero working diligently behind the scenes – the title insurance company. In this article, we shine a light on the crucial role of a title insurance company (us) in a real estate transaction and why our involvement is vital for a smooth and secure closing.

At the heart of our role, title insurance companies are responsible for conducting comprehensive title searches. We dive deep into the history of the property’s ownership, examining public records, deeds, and other relevant documents. Our mission? To uncover any potential issues that could affect the property’s ownership rights. From outstanding liens to undisclosed easements, we leave no stone unturned in their pursuit of a clear title.

During the title search process, if any title issues or defects are discovered, it’s the title insurance company’s job to identify and resolve them. These issues could range from unpaid taxes and judgments to undisclosed heirs or conflicting property boundaries. We work with the parties involved to address these challenges, ensuring that they are resolved before the property changes hands. Our expertise and attention to detail play a crucial role in mitigating risks and protecting all parties involved.

As the closing date approaches, the title insurance company plays a pivotal role in coordinating and facilitating the closing process. We collaborate with the buyer, seller, real estate agents, lenders, and attorneys to ensure that all necessary documents are in order and that all parties are prepared for a successful closing. From preparing the final settlement statement to ensuring that all required insurance policies are in place, we act as the glue that holds the transaction together.

One of the most essential roles of a title insurance company is to provide title insurance policies. These policies protect the buyer and lender from any unforeseen issues that may arise after the transaction is completed. Our underwriters issue the policies based on the results of our title search, offering peace of mind and financial protection to all parties involved. In the event of a future claim against the property’s title, we step in to defend and indemnify the insured parties.

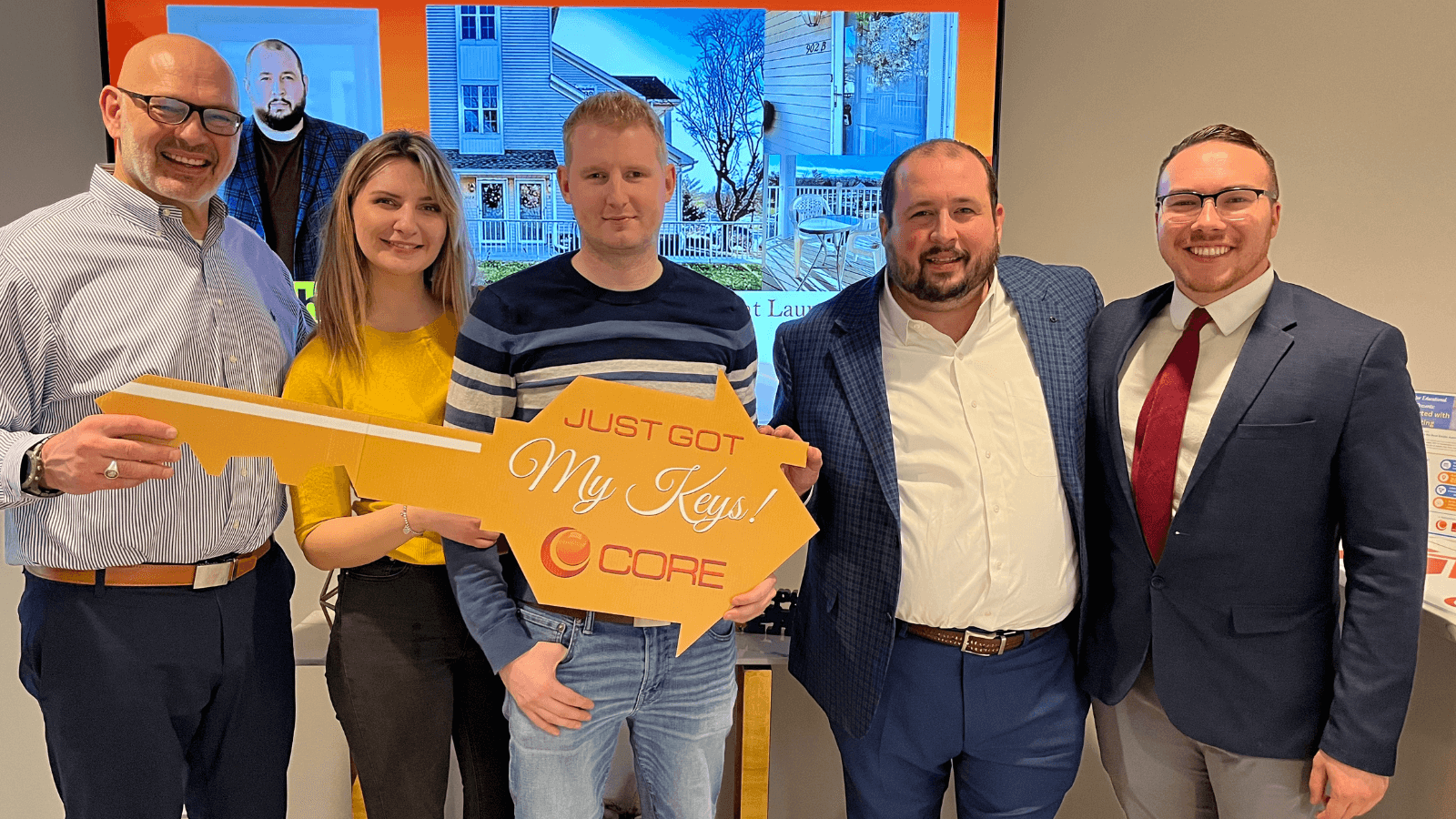

Throughout the entire real estate transaction, the title insurance company acts as a neutral third party, ensuring fairness and impartiality. We work diligently to protect the interests of all parties involved, upholding the integrity of the process. Our neutrality and commitment to professionalism make us a trusted local source of guidance and support for buyers, sellers, lenders, and other stakeholders.

Our role as title insurance company in a real estate transaction cannot be overstated. We are the unsung heroes who diligently work behind the scenes to ensure a smooth and secure transfer of property. From conducting thorough title searches and identifying and resolving title issues to facilitating the closing process and providing essential title insurance policies, our expertise and dedication make us invaluable partners in the journey of property ownership. So, the next time you embark on a real estate adventure, make sure your know the vital role of your title insurance company. Reach out to our team today for any real estate or closing questions!