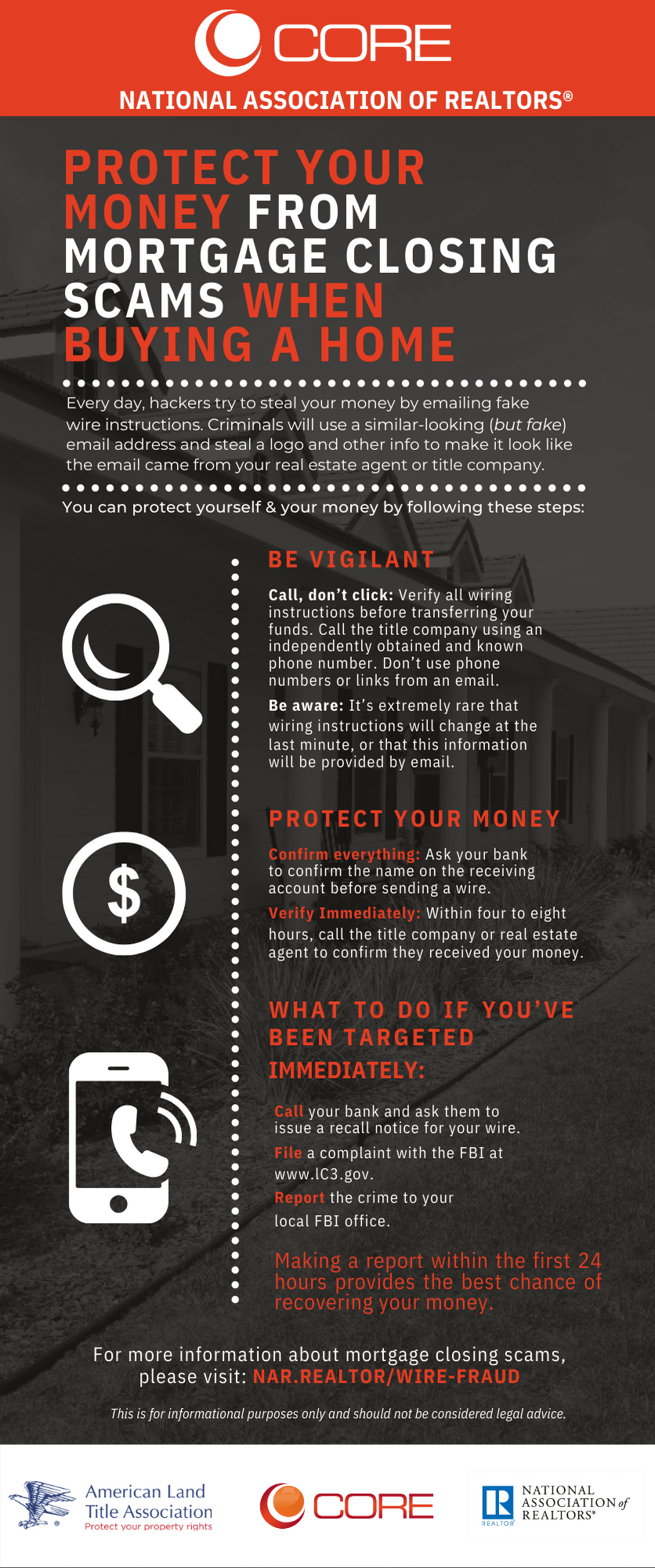

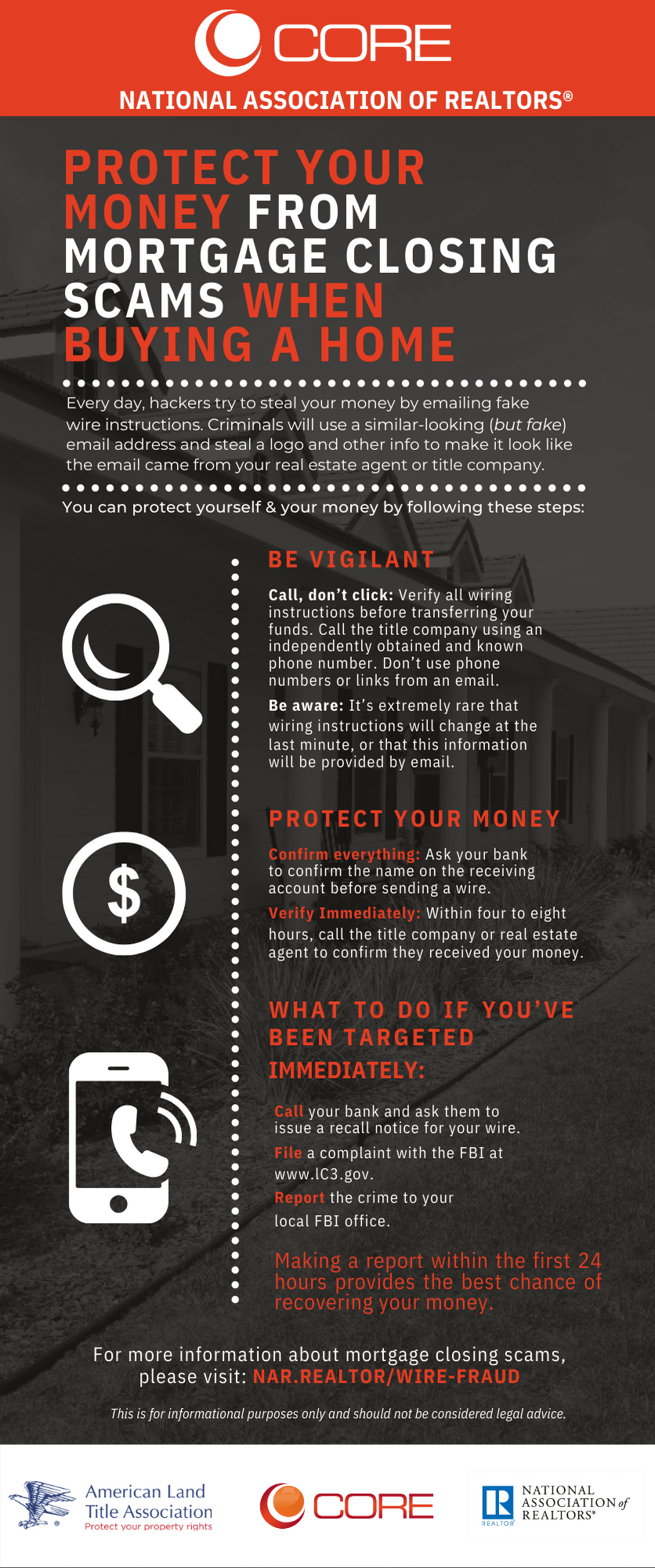

Criminals are smart. They know buying a home can be confusing and comes with a lot of paperwork. So, they’ll pose as a real estate agent, title agent or lawyer and send you fake account details to scam you.

Although steps are being taken in the industry to guard against this type of theft, adhering to digital best practices remains largely voluntary. Experts say it’s ultimately up to consumers to vet the fraud-prevention practices of every industry professional involved in a transaction. And consumers must use the most secure modes of transaction available, even if that means walking a paper check from the closing table to the teller’s window at their bank.

Digital theft is widespread and growing. Internet theft rose 37% from 2019 to 2020, according to the FBI’s Internet Crime Complaint Center, with 467,361 incidents last year. The real estate and rental fraud category of internet theft rose 35% between 2018 and 2020, the FBI estimates.

“The title and settlement industry has improved its digital hygiene and implemented many procedures to combat this fraud,” said Diane Tomb, ALTA’s chief executive officer. “But no matter how much money we spend, criminals will continue to target consumers and try to take advantage of them during a crisis. This is why we must continue to educate people about how they can protect their money when purchasing a home or refinancing a mortgage,” Timothy Zeilman, vice president for HSB, special ALTA guest contributor.

The tangle of agencies and professionals involved in a real estate closing understandably weakens consumers’ ability to detect who is responsible for what, said Andrew Liput, president and CEO of Secure Insight, a firm in Parsippany, New Jersey, that maintains a database of the qualifications of real estate professionals nationally. Confirming the fraud prevention commitment of each party can also be challenging.

“It’s very confusing and foreign,” Liput said. “The process is set up as an assembly line they are not part of. The borrower shows up at the closing table, they mainly know that there’s a moving truck outside and they’re scheduled to move. They’re trusting that all these people at the table, especially the lawyer, will properly execute the transaction and consumers assume that there will be no fraud.”

Here is how one of these scams usually plays out:

It seems so simple:

Your real estate agent sends you an email and asks you to send money to an account. You were expecting it—it was time for the down payment or to send the needed funds to close the transaction.

Cybercriminals are Monitoring:

But what you didn’t know was that a sophisticated cybercriminal, faked an email because they knew you were ready to buy a house. Maybe they saw a Facebook post you made or hacked someone’s computer system, but they knew you were ready to send money.

Wire Fraud is Initiated:

Real estate wire fraud is a sophisticated scam targeting individuals performing wire transfer payments. Often, emails will be a letter off, or similarly misleading, from the actual account and request the wire transfer. As an example, an email from Bank 101 was sent from jane.doe@bank701 instead of jane.doe@bank101.

Unknowingly, targets will then send wire transfers to the criminal’s account. Stop Wire Fraud with Education. Know the risks and the warning signs.

These criminals rely on trust. They know you trust your real estate agent, your lawyer or the bank, and they exploit that trust to steal from you. Be aware of the scams, always verify your wire instructions and work with a title insurance company you can trust.

Sources: https://stopwirefraud.org/how-wire-fraud-happens/

https://www.alta.org/news/news.cfm?20200428-Suspicious-Business-Emails-Increase-Survey-Shows

https://www.chicagotribune.com/real-estate/ct-re-wire-transfer-fraud-20210813-35nvi4bfwbcu5d2xx7t3zjzzza-story.html